I know what you’re thinking: with far more interesting topics like crime, immigration, Obamacare, and NSA spying, why bring up such boring, eye-glazing stuff as the Federal Reserve? Why not discuss those delicious partisan questions bandied about on what passes for television “news” – questions such as “Is Barack Obama a socialist?” or “Is the Republican Party on the brink of civil war?” Even fiscal policy – taxes, entitlements, discretionary spending, deficits and the debt – is easier to grasp than anything related to that black box known as the “Fed.”

But consider that…

– And yet, the top ten American billionaires added $101 Billion to their collective portfolios last year. The top one percent of American households now owns 60% of financial assets, and since 2009 they have realized 95% of all income gains.

– In 2013, economic growth was sluggish, at best – a meager 1.9 percent. The unemployment rate fell, but that statistical mirage masked the fact that a record number of Americans simply left the labor force altogether.

– And yet, the Dow Jones index of 40 industrial stocks was up 26 percent in 2013, reaching 16,504. That’s 10,000 points higher than the Dow stood on March 9, 2009, in the immediate aftermath of the economic crisis of 2008. And the Standard & Poor’s index of 500 key stocks rose 29%.

What do these seemingly disparate items have in common? They were all made worse (or better, depending on your perspective) by something called quantitative easing – QE, for short – a Federal Reserve program that Stanley Druckenmiller, former chairman of the hedge fund Duquesne Capital, recently called it “the biggest redistribution of wealth from the middle class and the poor to the rich ever.” Fact is, QE may be simultaneously the most important and the least understood story of the past five years. What isn’t ambiguous is the impact QE has had on income and asset inequality in the United States.

The Federal Reserve System was established in 1913 after decades of economic boom and bust. Its purpose is to provide a kind of stable backbone for the economy, modulating the natural excesses of a free market system. It accomplishes this by controlling the money supply, which is critical for stable pricing and moderate interest rates, and by coordinating the activities of the banking sector, including working closely with the US Treasury Department and the central banks of other nations. The President appoints the Fed’s governors and chairman, but the Fed is not a part of the Executive Branch. Instead, the Fed acts as an independent institution under broad congressional oversight, including the banking committees of the Senate and the House, as well as the Government Accountability Office (GAO), the audit and investigative arm of the Congress.

During and immediately after the sub-prime lending crisis of 2007-2008, the Fed invoked emergency powers to inaugurate a number of programs designed to ease credit and preserve liquidity in the banking system. These included things like “MBS,” in which the Fed bought bad loans backed by government-sponsored entities like Fannie Mae and Freddie Mac; and “TALF,” in which the Fed provided loans to eligible institutions so that they could acquire asset-backed securities. The Fed also provided direct assistance to specific firms in order to keep them afloat, as with the insurance giant AIG, or induce them to purchase failing firms, as happened in JP Morgan Chase’s acquisition of Bear Stearns.

Taken together, these first emergency steps came to be known as “QE1,” or the first round of quantitative easing. QE1 was widely seen as an appropriate response to the crisis, with the Fed acting as the lender of last resort in order to prevent a wholesale collapse of the banking system. In QE1, the Fed added $2.1 trillion to its balance sheet. How did it come up with the cash? Simple: when the Fed needs to, it just adds zeroes to its balance sheet. In other words, it “prints” more money. In 2010, the Fed embarked upon QE2, which involved the purchase of $600 billion in US Treasuries – bills, notes, and bonds – in order to inject even more liquidity into the credit markets and thereby stimulate the economy as a whole, which had foundered in recession.

In September of 2012, the Fed announced yet another round of quantitative easing that continues to this day and has come to be known as QE3. Under QE3, the Fed purchases $85 billion a month in treasuries from its preferred list of 22 “primary dealers. Here’s what happens: a dealer has a bond certificate that belongs to the dealer itself or its client. The dealer sells that certificate to the Fed in this month’s competitive auction. The dealer is then credited with cash on its balance sheet. In theory, the dealer or the dealer’s client now plows that cash back into the economy in the form of loans for business start-ups, investments in plant and equipment, research and development, hiring, etc. The program is intended to turn the Fed’s made-up money into productive capital that will stimulate the economy, encourage innovation and risk, and restore full employment.

But that is not what happens, as any review of the business pages will reveal. When the Fed transfers its newly minted cash, banks and their clients typically do one of four things: they either hold on to the money, which inflates the price of their own stock; they buy stock in other companies, which drives those stock prices higher; they buy more treasuries to sell at a mark-up to the Fed; or they use the profits realized to acquire profitable companies in fields other than finance. Rinse and repeat. The financial spin cycle blows an asset bubble while the real economy – the economy you and I inhabit – limps along.

Who are the “primary dealers” that play such an important role in this scheme? They are the brokerage departments of 22 big banks, including Goldman Sachs, JP Morgan Chase, Citigroup, HSBC, and others. They deal exclusively with the Federal Reserve Bank of New York, which is famous for its revolving doors – especially those that open into and out of Goldman. Stephen Friedman is a good example. In 2009, Friedman, a former Goldman Sachs CEO, was administering QE1 as chair of the New York Fed when it was discovered that he was actually still a member of the Goldman board! Friedman was both the bank regulator and the banker he was regulating. He resigned, of course, but not before he was able to buy 52,000 additional shares of Goldman stock and pocket a cool $3 million.

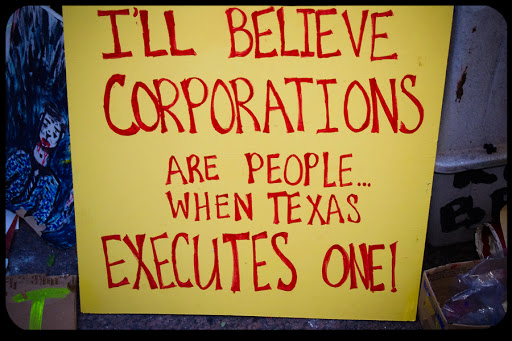

What Friedman did was legal, believe it or not; but the Fed’s partners are routinely involved in criminal behavior. In 2012, HSBC was fined $1.9 billion for money laundering cash from Mexican drug cartels. In 2013, JP Morgan Chase paid fines totaling $20 billion for everything from foreclosure fraud to manipulating electricity delivery to California – the same thing that got Enron shut and CEO Ken Lay sent to jail. But no one at JPM will be charged; it just doesn’t work that way on Wall Street.

So, who benefits from QE aside from the primary dealers themselves? Well, 52% of Americans own stock in some form, but the median value of that stock is surprisingly low. Remember, 60% of financial assets are owned by 1% of households. Any way you cut it, quantitative easing and the resulting asset bubble has been a tremendous boon for the wealthy because as Druckenmiller dryly notes, the wealthy have assets while the rest of us have debts. But it’s worse – not only have the wealthy seen the value of their existing holdings skyrocket; they have quite naturally used much of that profit to purchase everything from farmland and investment properties to gold and silver. And this has taken place during a period when the middle class has been divesting assets in order to survive a jobless recovery. The net result of quantitative easing has been a vast vacuuming up of middle class wealth by the richest households in the country.

As has been pointed out before, God doesn’t love the wealthy sinner any less than he loves the poor sinner. The Church exercises a preferential option for the poor not out of a greater love, but in pursuit of justice. In this case, we are concerned with distributive justice, which has to do with the fair allocation of goods in society. The Federal Reserve’s policy of quantitative easing, which may have begun with the best intentions, has clearly become a blunt instrument of distributive injustice that will lead to greater social, economic, and political instability. As Pope Emeritus Benedict XVI wrote in Caritas in Veritate:

Mark Gordon is a partner at PathTree, a consulting firm focused on organizational resilience and strategy. He also serves as president of both the Society of St. Vincent de Paul, Diocese of Providence, and a local homeless shelter and soup kitchen. Mark is the author of Forty Days, Forty Graces: Essays By a Grateful Pilgrim. He and his wife Camila have been married for 30 years and they have two adult children.